The team of academic mentors at Sodask is exclusively comprised of individuals from QS-ranked top 50 institutions. We guarantee an accuracy rate exceeding 97% for all answers provided. Each mentor admitted to the Sodask platform has undergone a meticulous verification process, encompassing stringent qualification certification and rigorous selection procedures. This rigorous screening ensures that our mentors possess the necessary expertise and professional scholarly acumen to deliver authoritative and precise responses.

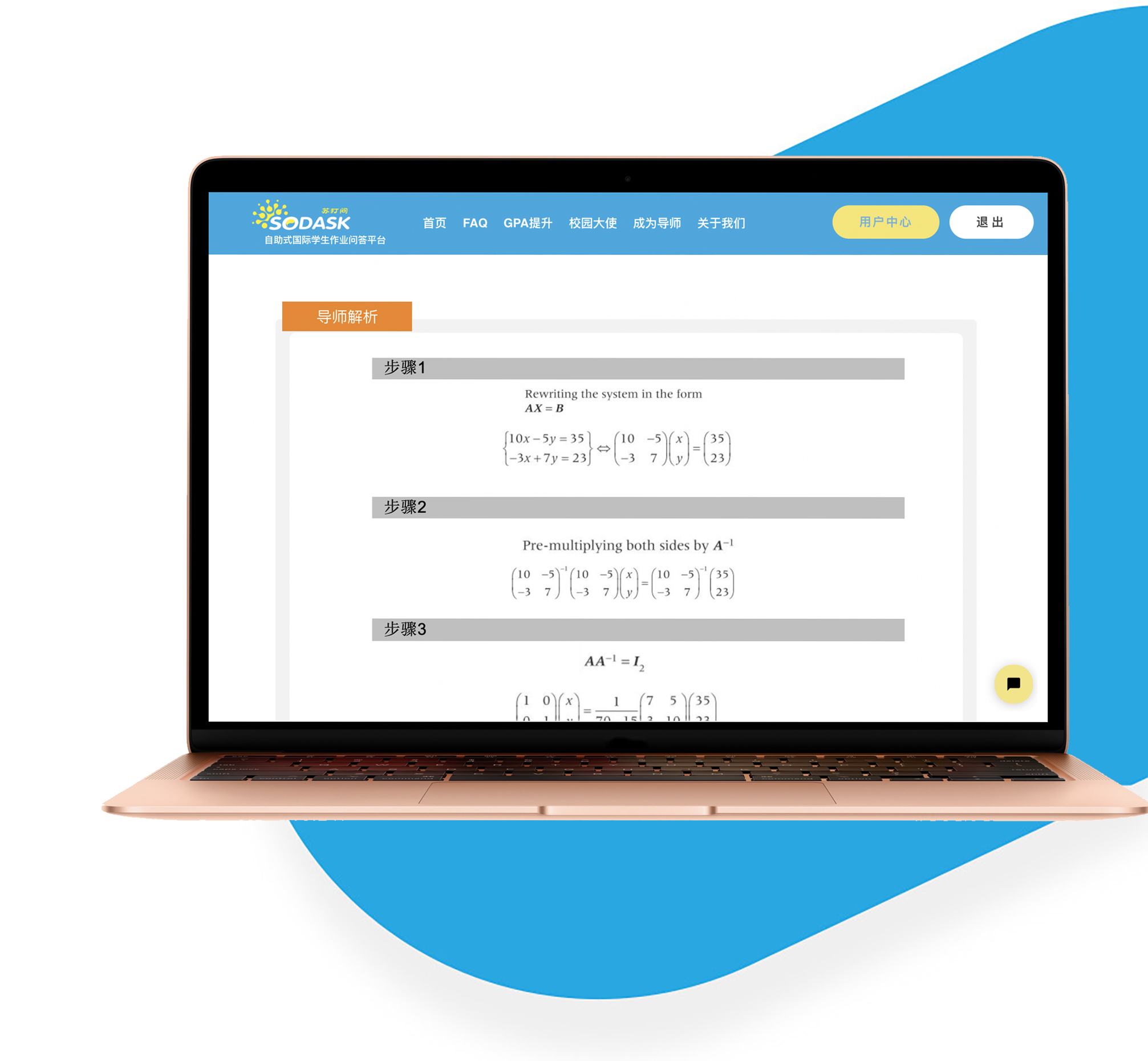

Sodask mentors go beyond providing online answers to students' inquiries by offering tailored analyses to address diverse student needs. In addition to resolving specific queries, mentors impart clear problem-solving strategies, facilitating the development of effective study methods and fostering students' problem-solving habits.

Students only need 3 steps (upload-select-submit) to intelligently match students with the most suitable tutor in a short time. At the same time, we will communicate the progress of the problem by email, and students and tutors will communicate directly to ensure that there is no customer service intervention. Ensure the efficiency of answering questions in the most convenient and quick way.

Driven by a commitment to serve students, we prioritize answer quality while actively protecting and advocating for student rights. With a global reach, we have earned widespread acclaim. In the event of any dissatisfaction, students are welcome to request a mentor replacement or a full refund as part of our customer satisfaction guarantee.

Based on students' learning needs, we provide step-by-step answers to questions, enabling students to acquire not only the correct solutions but also clear learning strategies and efficient problem-solving methods.

| Name | School | Phrose | Content | View |

| Classmate Bai | University of Queensland | University | Chemistry Tutoring | View details> |

| Student Lu | University College London | University | Physics tutoring | View details> |

| Classmate Liu | University of California (UCLA) | University | Economics Tutoring | View details> |

| Classmate Mi | Xihua International High School | High School | Math tutoring | View details> |

| Classmate Li | Boston University | University | Computer programming tutoring | View details> |

| Classmate Bai | University of Queensland | University | Chemistry Tutoring | View details> |

| Student Lu | University College London | University | Physics tutoring | View details> |

| Classmate Liu | University of California (UCLA) | University | Economics Tutoring | View details> |

| Classmate Mi | Xihua International High School | High School | Math tutoring | View details> |

| Classmate Li | Boston University | University | Computer programming tutoring | View details> |

| Classmate Bai | University of Queensland | University | Chemistry Tutoring | View details> |

| Student Lu | University College London | University | Physics tutoring | View details> |

| Classmate Liu | University of California (UCLA) | University | Economics Tutoring | View details> |

| Classmate Mi | Xihua International High School | High School | Math tutoring | View details> |

| Classmate Li | Boston University | University | Computer programming tutoring | View details> |

| Classmate Bai | University of Queensland | University | Chemistry Tutoring | View details> |

| Student Lu | University College London | University | Physics tutoring | View details> |

| Classmate Liu | University of California (UCLA) | University | Economics Tutoring | View details> |

| Classmate Mi | Xihua International High School | High School | Math tutoring | View details> |

| Classmate Li | Boston University | University | Computer Programming Tutorial | View details> |

Boston University

Brown University

Northeastern University

Ohio State University

Columbia University

Harvard University

Cornell University

Michigan State University

University of Southern California

New York University

Purdue University

Yale University

University of Illinois at Urbana-Champaign

UCLA

Indiana University

University of California, Berkeley

Pennsylvania State University

University of Minnesota

University of Washington in Seattle

Arizona State University

University of Michigan, Ann Arbor

Illinois Institute of Technology

Rutgers University

University of Texas at Dallas

University of Creative Arts

University of Cambridge

University of Bath

Imperial College

University of East Anglia

Durham University

University of Warwick

Loughborough University

Lancaster University

University of Leeds

University College London

Oxford University

University of St. Andrews

London School of Economics

University of Exeter

University of Surrey

University of East Anglia

University of Birmingham

University of Sussex

University of Bristol

University of Nottingham

University of Southampton

Newcastle University

University of Kent

University of Sheffield

University of Leicester

Queen's University Belfast

King's College London

University of Dundee

University of Glasgow

University of Essex

University of Reading

University of Manchester

Aston University

Royal Holloway

SOAS, University of London

Harper Adams University College

University of Edinburgh

Heriot-Watt University

University of Liverpool

University of Liverpool

Queen Mary University of London

Buckingham University

Keele University

University of Stirling

University of Aberdeen

Swansea University

Cardiff University

Coventry University

University of Strathclyde

Liverpool Hope University

City, University of London

Falmouth University College

Brunel University

Goldsmiths

Aberystwyth University

Nottingham Trent University

Bianshan University

University of Portsmouth

University of the West of England

Bangor University

Bournemouth University

Royal Agricultural College

Bournemouth Arts University

University of Hull

Northumbria University

De Montfort University

Ulster University

Oxford Brookes University

St George's College, University of London

University of Adelaide

The Australian National University

Curtin University

University of Queensland

Macquarie University

Monash University

University of Melbourne

University of Wollongong

University of Western Australia

University of Sydney

University of Technology Sydney

University of New South Wales

Brock University

University of Toronto

University of Guelph

University of Waterloo

Queen's University

Carleton University

McMaster University

University of Windsor

University of Ottawa

University of Western Ontario

Simon Fraser University

York University

Republic Polytechnic

Nanyang Technological University

Parkway School of Nursing, Singapore

Singapore Management University

National University of Singapore

Singapore University of Technology and Design

Singapore University

Ngee Ann Polytechnic, Singapore

University of Auckland

Auckland University of Technology

University of Otago

University of Waikato

Victoria University of Wellington

University of Canterbury

Lincoln University

Massey University

Irish Institute of Public Administration

National University of Ireland Galway

National University of Limerick

National University Maynooth

Dublin City University

University College Dublin

Trinity College Dublin

University College Cork

City University of Hong Kong

The Open University of Hong Kong

Hong Seng University of Hong Kong

Hong Kong Institute of Education

Hong Kong Baptist University

The Hong Kong University of Science and Technology

The Hong Kong Polytechnic University

Lingnan University of Hong Kong

Hong Kong Centennial College

Hong Kong Shue Yan University

The Chinese University of Hong Kong

The University of Hong Kong